Logistics Tech Review: New DOT Secretary, Tesla to Build Minivan, End of Freight Recession

Policy changes and market recovery set stage for 2025

This week's headlines feature President-elect Trump's nomination of Sean Duffy for Transportation Secretary, Tesla's hint at entering the minivan market, and FreightWaves declaring an end to the freight recession. The logistics tech sector faces potential changes in trade and autonomous vehicle regulations as the new administration takes shape.

What Trump's Trade Policy Means for Logistics Tech

The incoming administration's trade policies might drive significant changes in logistics technology adoption. While regulatory shifts could benefit some sectors, the broader impact of increased tariffs will reshape technology priorities across the industry.

Key areas of impact:

Supply Chain Visibility: The 2018 tariff implementations demonstrated the need for better supply chain visibility. Companies are now investing in technology that enables rapid scenario planning and sourcing shifts. Platforms that can analyze tariff implications in real-time will see increased demand.

Port Tech: Port congestion issues could worsen under new trade policies, accelerating investment in terminal automation and operating systems. Rumors are already swirling of another potential port strike at the New Year.

Domestic Networks: Potential reshoring driven by trade policy could fundamentally alter domestic freight patterns. Network optimization and automation technology will become increasingly critical as companies adjust their distribution strategies. Meanwhile, China looks to bypass US ports and opened a massive port in Peru last week.

The most successful technology providers won't necessarily be those with the most advanced solutions, but those offering practical tools for adapting to rapid trade policy changes.

Industry Pulse

President-elect Trump selects former congressman and Fox News host Sean Duffy as Transportation Secretary [FreightWaves]

Craig Fuller, CEO of FreightWaves, declares end of freight recession, citing improving spot rates and industrial production [FreightWaves]

Trump administration expected to ease autonomous vehicle regulations and reduce testing requirements [Transport Topics]

Elon Musk suggests Tesla is developing "high passenger-density vehicle," pointing to potential entry into minivan market [Twitter]

Ulta Beauty adopts micro-fulfillment strategy, aiming to reach 80% of customers with 2-day delivery through smaller, localized facilities [Supply Chain Dive]

Data Point of the Week

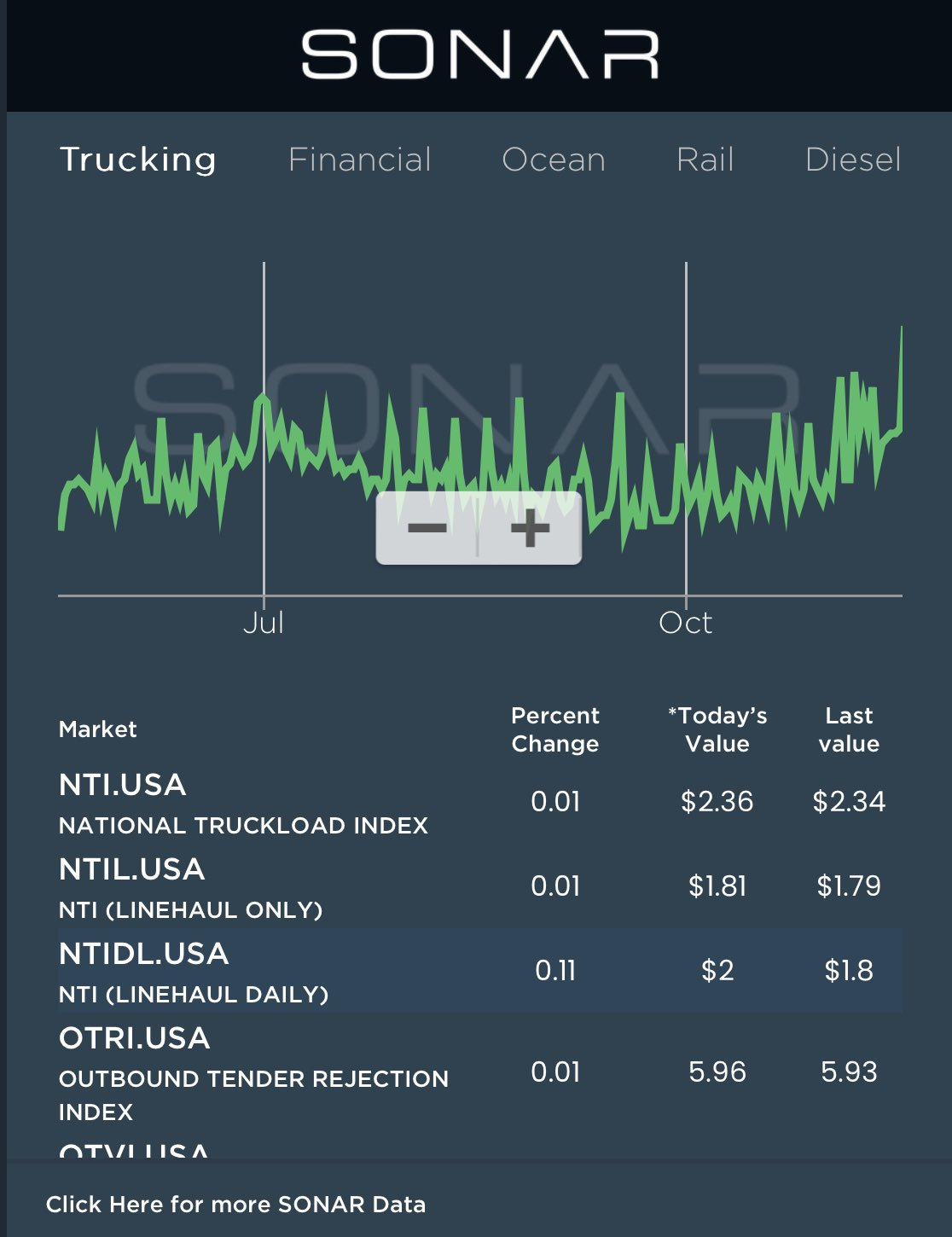

FreightWaves SONAR Recovery Index Hits 60%

FreightWaves' SONAR Recovery Index has reached 60%, its highest level since January 2023. This comprehensive market indicator suggests a significant shift in freight market conditions.

Why it matters: The index provides quantitative validation of market recovery predictions, supporting other indicators of improving conditions for 2025.

Final Thoughts

While the incoming administration signals significant policy changes ahead, only time will tell whether these shifts will materially impact freight tech companies and startups. The market recovery provides a positive backdrop, but technology providers will need to prove their value in helping customers navigate whatever changes actually materialize in 2025.

If you haven’t already, please subscribe to this newsletter. Follow on Twitter: @LogisticsReview, @brianshin22